Net Metering in the States: A 2020 Update

Click here to download the study

Executive Summary

Net metering (NEM) is a billing mechanism that allows customers of electric utilities to be compensated for the electricity they sell to their utility. Its original intent was to encourage the development of solar at an attractive rate. Currently, while its use continues to grow in some states, it appears to be leveling off and diminishing in others. Under a variety of compensation schemes, utilities can pay net metering customers as much as the full “retail rate” charged to customers. Across the country, the rate paid to NEM customers varies from place to place and from utility to utility. As solar becomes more affordable and is implemented by more customers, discussions about the need and usefulness of retail rate NEM going forward have become more important.

Over the past 25 years, residential and other electric customers such as farms or industrial customers have installed solar panels or photovoltaic (PV) residential systems on their homes or at their property. There are numerous reasons customers chose to do so, including lucrative tax incentives, an assumption of lower overall energy bills, environmental concerns or the desire to self-generate.

When compensated at the full retail rate, NEM unfairly subsidizes solar power-generating consumers by transferring their share of the costs of grid infrastructure maintenance and investment to consumers unwilling or unable to install expensive generation equipment. These grid upkeep costs average over 60% of the retail price to consumers. Since the compensated “retail rate” per kilowatt hour is greater than the actual value of the power delivered by customer-generators to the system, non-generating consumers pay higher and higher energy costs to offset the excessive payments made to NEM customers. It also encourages generating customers to use more electricity than they would otherwise.

This paper reiterates that, to best support all customers, NEM policies should be reformed upon finding:

Most recent studies do not show net benefits for subsidizing net metering customers at the retail rate. Public benefits can often be achieved at less cost. Overcompensating net metering customers at the retail rate represents a significant cost shift from generating to non-generating consumers, raising the overall price of electricity generation, distribution, and transmission.

Net metering policies are deeply regressive, benefiting the well-off, self-generating consumer at the expense of low-income non-generating consumers.

NEM compensation structures at the retail rate do not benefit the grid’s reliability or reduce overall consumer costs. Other, non-generating consumers are being unfairly disadvantaged, paying a large subsidy to generating consumers.

While some states have begun to take more explicit actions to eliminate NEM cross subsidies and improve their pricing schemes, by moving away from full retail net metering while retaining an environment supporting NEM development, other states are going in the opposite direction, like expanding NEM at the retail rate, which results in overpayments that harm customers who can least afford it.

Introduction

The U.S. Energy Information Administration reports just over 2 million electric customers are ‘net metering’ in 2020. This is up from 140,000 in 2010, for an increase of 1300 percent. These customers generated and sold back to their respective utility 1,594,373.437 Megawatt hours in 2019, or approximately twelve times the 2010 figure. These numbers reflect growth rates of approximately 29% per year for both the number of customers and the amount of electricity sold back to utilities. These rapid growth rates are largely a result of overly supportive and overcompensated subsidy policies, such as retail rate NEM. States have been aggressively pursuing net metering, often using this mechanism to encourage expanded development of solar and other renewables. At the Federal level, the Federal Energy Regulatory Commission (FERC) has mostly left to the states all price regulation of net metering. Recently, some states have started to move away from retail rate net metering, as policymakers have become more aware of the issue of fairness, and no longer tolerate net metering customers being heavily subsidized by all other customers.

In 2018, the State Government Leadership Foundation (SGLF) published a Report outlining these issues and making recommendations on how best to correct them. This is an update of that report and focuses on net metering developments in six states (Arizona, Arkansas, California, Indiana, Oklahoma, and Wyoming.) We chose these states to ‘bracket’ the policies from most favorable to net metering to most balanced for other customers, and summarize the treatment net energy metering receives in these states.

What is Net Metering?

Net metering, dating back to the early 1980s, is a utility billing mechanism that pays customers with rooftop solar (or other distributed generation) for the electricity that they self-generate and/or any electricity they wish to sell back to the grid.

Under NEM, a customer’s electric meter is “rolled back” based on the amount of electricity they generate at their home or business. Under retail net metering, a customer with rooftop solar panels gets paid the retail price of electricity for any power they sell to the electric company when their generation exceeds their own demand. However, they avoid fully paying the electric company for the fixed costs of the grid, which they still utilize, in both delivering excess generation and consumption of any additional electricity to meet their own needs. Some states have instituted “buy all, sell all” net metering and under distinct rates to account for this phenomenon. Even though the customer is only providing generation and not transmission or distribution services, they are still being compensated for all three services, and paid full retail, thus overcompensating customer generators for their contribution to the system.

Providing electricity to homeowners and businesses entails four components: making the electricity (generation), moving the electricity (transmission), delivering the electricity (distribution) and miscellaneous and overhead for other programs (for example, the costs of programs to support income qualified customers or promote other policy goals, such as efficiency). Historically, electricity was generated at large power plants that were built to capture economies of scale, sent through transmission lines, and then distributed to homes and businesses. It was a one-way transaction – from generation by a company to consumption by a customer.

To understand the economics of net metering billing policies, it is useful to understand that several new technologies, like solar photovoltaic (PV), benefit more from economy of scope than scale. Factory mass production is the key to cost reduction, although building larger production factories (and thus benefit from economy of scale) also leads to reduced unit costs. PV costs have come down rapidly in the past few years and are increasingly being matched with storage batteries at the home.

Merely looking at the costs of solar panels, though, only tells part of the story of expanding distributed generation (DG). Each rooftop panel that is installed requires investment in and connection to the common electric grid in order to be effective. As described by the Institute for Energy Research (IER), when interconnected to the distribution grid, customers with solar panels (or other DG facilities) can draw electricity from the utility when their panels do not provide sufficient power for their needs (i.e., night time, overcast days, high usage on site, etc.) and sell excess electricity back to the utility when panels generate more than is immediately consumed. This changes operation of the distribution network, and occasionally the transmission grid, by creating a two-way power flow, rather than the historical configuration of one-way flow.

Equity Concerns

Historically, utility rates have been designed to include all costs of service: generation, transmission, and distribution. The latter two are the delivery cost representing ‘the grid’ while the former is the commodity and represents power plants (or any form of generation). Typically, rate setting involved estimating the total revenue requirement for each type of cost, summing those costs and dividing by the forecast total volume to be bought by and delivered to customers. Customers were concerned only with the delivered total cost, and that was charged by a single entity, the utility.

While a majority of utility revenue from residential customers has traditionally come from charges on the volume consumed, the majority of utility costs is either fixed or a function of customers’ instantaneous demands, measured in kilowatts (expressed in kW as opposed to energy usage, or kWh). So, the structure of electric rates (i.e., revenues obtained from volumetric throughput that fluctuates) when compared to the nature of a utility’s infrastructure and other costs that are mostly fixed have been misaligned. ,

Table 1 provides percentage of each states’ cost attributable to transmission and distribution, as estimated by the U.S. Energy Information Administration for their dominant RTO (regional transmission organization). Naturally, the component breakdown varies from state to state with population density and location of power generating sources relative to where it is ultimately consumed. It also varies from year to year as costs vary with weather and such. The generation (energy) component costs are also growing much slower than either transmission or distribution (1.6%/year v. 2.9%/year) and will likely continue to diminish in importance. Given the importance of the proportion of T&D cost to total cost in the policy discussions around NEM, more effort should focus on resolving this data disparity. However, we consider the estimates of T&D costs from EIA, while consistent among themselves to be at the low end of the range of credible estimates.

Table 1

Transmission and Distribution as a Percent of Total Cost by State

Table 2 identifies the current development status of net metering in the six states included in this report:

Table 2

Net Metering in 2019

As reported by FERC, capacity from distributed energy resources (DERs) utilizing net metering rose to a new high of 23 GW in 2019, up more than 4 GW (or 17%) from 2018 and 20 GW (87%) from 2010. Growth was driven primarily by five states: California, New Jersey, Massachusetts, Arizona, and New York. These five states make up 70 percent of the total net-metered capacity in the country, with California alone making up 40 percent of total capacity in 2019.

Poor Customers Subsidize Rich Customers

Beyond mere cost-shifting, net metering can be regressive and disproportionately impact low- income customers, since many low-income customers do not have, do not want, or cannot afford private solar systems. Many studies have found that owners of rooftop solar are more affluent than those without rooftop solar. In three Commission-backed studies (in California, Nevada, and Hawaii), the consulting firm E3 found income disparities between rooftop solar customers and the rest of the residential class. Another report for the Louisiana Public Service Commission (LPSC) by Acadian Consulting Group found that rooftop solar customers within the LPSC’s jurisdiction had median household incomes of $60,460 relative to the statewide median household income level of only $44,673.2 This is especially important in states like Arkansas, 47th in per capita income, the 4th poorest state in the nation, with many customers on the brink as it is without being forced to pay part of others’ bills.

Speculative Costs Have No Place in Cost-Benefit Studies

There are numerous ways to evaluate the impact of net metering. One such method is through a cost-benefit analysis, which attempts to quantify the costs and the benefits associated with providing net metering compensation for customers with private generation. Traditionally, these studies are done by calculating the difference between any benefits (that is, the costs that a utility avoids because of net-metered customers) and any new costs created by those customers. They are typically limited to quantifiable hard costs and savings.

While cost-benefit studies are frequently conducted both by external parties and at the request of state regulators, systemic problems abound in attempting to estimate the economic value of net metering. Studies can and have included speculative benefits or inflated estimates of benefits. For example, a cost-benefit study with overly increased future fuel price projections will have substantially higher calculated benefits through the assumed ‘avoided’ costs associated with power generation.

Additionally, cost-benefit studies can be skewed by the inclusion of elements that should not factor into the evaluation of net metering, such as the worldwide impact of climate change and the associated social cost of carbon.

These elements—often included without much assessment or verification—are most often seen in “studies” that are trying to prove outsized benefits of net metering. An honest evaluation of existing studies reveals that properly conducted cost-benefit analyses can be done. And when they are, the results show net costs, not net benefits.

In the ongoing debate about net metering compensation rates, there are vocal groups that wish to promote inflated benefits of rooftop solar. Many of these groups are made up of solar developers who stand to profit from private solar development, without regard to net metering’s effects on non-generating customers. Many so-called “studies” that are frequently referenced by these groups either have no quantitative rigor, or worse, are meta-studies that cherry pick from a subset of the literature to prove a particular point.

For example, in her critique of a Brookings article on net metering, Lisa Wood, a nonresident Senior Fellow at Brookings and lead at the Institute for Electricity Innovation, noted: “In reviewing NEM studies, Muro and Saha [authors of the original Brookings article] chose to focus on a handful of studies that show that net metering results in a benefit to all customers, to the exclusion of studies showing the opposite.”

A good example of Wood’s critique is the ongoing citation of a cost-benefit report that the firm E3 conducted for the Nevada Utility Commission. Wood explains, “[t]he original report came out in 2013, but very soon after the study was published, the cost assumptions for the base-case scenario—which showed a net benefit of $36 million to non-NEM customers (assuming $100 per MWh for utility- scale solar)—were found to be incorrect, completely reversing the conclusion. In E3’s updated report, issued in 2016, the original $36 million net benefit associated with NEM for private rooftop solar turned into a $222 million cost to non-NEM customers when utility-scale solar was priced at $80 per MWh.” Yet, despite the update based on verifiable cost data, the 2013 report is still touted by proponents of net metering. This particular case speaks to a larger point in that studies of benefit and costs should follow best analytic practices, be current, and not subject to preconceived outcomes. As a result, state policymakers should consider and acknowledge these attributes when evaluating different cost-benefit studies.

Matching Policy Goals with Policy Tools

Perhaps the biggest question when it comes to a cost-benefit analysis is: When should it be used? The answer is only in combination with other methods of evaluation. A policy may provide net benefits but be constructed in such a way that more effective or more efficient methods are overlooked. For example, does encouragement of net metering result in the net improvement of grid reliability less expensively than other grid enhancements?

It is important to remember that net metering itself is not a public policy objective. It is a mechanism to achieve a specific policy goal – in this case, a subsidy to incent private solar development. After more than a decade of this subsidy (when set on retail rates), review is needed to determine whether this is the right policy going forward. Policymakers and regulators are tasked with deciding policy objectives. For energy and electricity issues, those objectives might be lower prices, reduction in carbon emissions, improvements in reliability, or greater penetration of renewable energy. In each of these cases, policymakers should ask themselves: what is the lowest cost, most efficient, and most equitable method to achieve the desired end goal?

If the policy goal is to simply encourage solar energy development at any cost, policymakers should heed the warnings of Richard Schmalensee. Schmalensee, the Howard W. Johnson Professor of Management Emeritus and Professor of Economics Emeritus at MIT and former director of the MIT Center for Energy and Environmental Policy Research, spoke to this point in his comments to DOE in response to a Request for Information on net metering. In 2015, he directed MIT’s multidisciplinary study The Future of Solar Energy, to “assess solar energy’s current and potential competitive position and to identify changes in U.S. government policies that could more efficiently and effectively support the industry’s robust, long-term growth.” He made two points relevant to the costs and benefits of NEM. First, although distributed (or residential) solar energy can bring benefits to homeowners and communities, it is not the most economically efficient way to achieve environmental goals – it costs too much for the benefits delivered. Second, compensating NEM customer generators with retail rates, widely used by states as an incentive to increase deployment of residential solar, presents serious equity problems – it is unfair because it overcompensates these customers for the benefits they deliver while simultaneously allowing them to bypass charges to use the distribution and transmission systems. The bottom line is that retail rate NEM is outdated and the most costly and inefficient means to encourage solar development; hence, its use actually impedes solar growth.

Meter Aggregation

Aggregate (or sometimes called virtual) net metering allows customers with multiple electric meters within a single utility's service territory to offset consumption at multiple locations using a single generation source. For example, aggregate net metering allows a farmer to use net metering credits from a single renewable energy system to offset the consumption measured at multiple meters on the farmer’s various properties.

At least 17 states have authorized aggregated net metering, including Arkansas and California, two of the states included here. Overly liberal and improperly limited aggregation policies are a significant threat to the long-standing regulatory compact between regulators, customers, and utilities. Net metering is for customer-generators that built systems meant to offset all or part of their consumption – not to build and aggregate systems that are oversized and designed to take advantage of retail rate compensation to the detriment of other, non-generating customers.

States have placed specific requirements on aggregated net metering systems based on customer type including agricultural or non-profit or government facilities versus private ownership. It is typically limited to single customers although a very few states allow multiple customers to join forces.

States vary in the specifics of what is allowed and not allowed, including size and geographic proximity. Typically, meters must be located on a single or adjacent owned property, although a few states allow aggregation across multiple locations anywhere within the utility service territory.

Recent State Level Activity: States in Focus

State regulators and legislators interested in moving beyond traditional 1:1 retail rate net metering have several recent (and quality) examples from which to choose. Below we try to draw lessons from a select group of states and lay out some of the policy pathways that can be explored in an effort to find more equitable compensation of net metering.

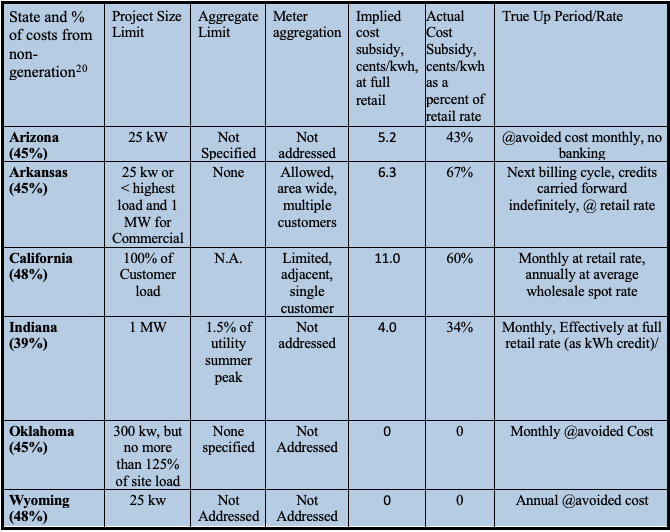

A state-level discussion of net metering reform efforts is crucial information for policymakers and regulators as such efforts provide important exemplars of the recognition that existing NEM policies are no longer serving all customers. Table 3 summarizes the net metering metrics in our focus states. These six were selected to represent the entire spectrum of NEM policies, from aggressive support to tempering tolerance for retail net metering. In Table 3, “implied cost subsidy” (column 5) is calculated as the difference between the state’s average wholesale energy and retail bundle price, while the actual cost subsidy (column 6) is calculated as the difference between net energy metering buyback rate (or feed-in tariff) and average wholesale energy, expressed as a percent of the retail rate.

While California often describes themselves as the leader in NEM (and other ‘socially responsible’) policy topics, in the case of NEM, it is actually Arkansas that is most favorable to NEM expansion in three areas: price structure, size limitations and meter aggregation.

Table 3

Net Metering in Six States

Arizona

Arizona has the third-most installed solar PV capacity in the country at 3,913MW, behind only California and North Carolina.

Retail rate net metering was repealed by the Arizona Corporation Commission (ACC) in December of 2016. A replacement system, known as a feed-in-tariff, was adopted that pays homeowners a different rate for export to the grid than for consumption. From October 1, 2019 onwards, APS, a large utility covering much of Arizona, values customer excess solar generation at 10.45 cents per kWh generated, compared to the 12.12 cents/kWh average retail cost of electricity in Arizona. APS customers will receive this value for energy their solar system sends to the grid for 10 years after interconnection is complete. Future rate cases or rulemaking proceedings will decide what will happen to then-current and future customers. While this provides a contribution to fixed costs for transmission and distribution by net metering customers, it is unclear if the 1.67 cents/kWh differential is adequate. The differential should be close to 5 cents/kWh if the breakdown of price components noted above on page 6 (for national averages) holds in Arizona.

Arkansas

On April 29, 2016, the Arkansas Public Service Commission (APSC) opened Docket No. 16-028-U, "In the Matter of an Investigation of Policies Related to Renewable Distributed Electric Generation." Later, on November 9, 2017, the Commission expanded the Docket, to "In the Matter of an Investigation of Policies Related to Distributed Energy Resources." On July 27, 2018, the Commission issued Order No. 10, requesting the Parties to file pre-Workshop procedural comments and announced that an initial Workshop on DER and Grid Modernization Procedural Issues.

In December 2019, the APSC heard from stakeholders regarding potential changes to net metering compensation rates and other considerations. Electric utilities argued that high net metering rates are being passed along to non-solar customers. Solar owners argued that any lowering of their buyback rates would increase their break-even point, while solar developers argued that this would slow solar development in the state. Solar proponents also requested that if rates were lowered, current solar customers be grandfathered with the current rates for 20 years. Entergy Arkansas indicated support for grandfathering of existing net metering customers, but for a shorter period.

In Order 28 (June 1, 2020) the APSC approved rules allowing residents with new rooftop solar systems to continue to receive a 1:1 net metered retail credit grid until at least 2023 . This results in the highest net metering buyback rate as a percent of retail prices (69%) of the six states included in this report. Coupled with the aggressively supportive other features (project size, project aggregation cap, true up period, inclusion of commercial customers), this makes Arkansas perhaps the most ‘friendly’ state for net metering proponents, even though it has the lowest retail rate for residential customers.

Order 28 established rates, terms, and conditions for net metering in Arkansas and also implemented the provisions of Act 464. The law increased the allowed generating capacity for commercial solar systems from 300 kilowatts to 1 megawatt. The new net-metering rules allow existing agreements between net-metering customers and utilities to remain in place, or grandfathered, for 20 years .

Starting in 2023, a utility can request an alternate net-metering rate structure “that is in the public interest and will not result in an unreasonable allocation of, or increase in, costs to other utility customers.”

California

California utility customers who install certain renewable generation facilities are eligible for a net metering program. Participation in NEM does not limit a customer-generator's eligibility for any other rebate, incentive, or credit provided by an electric utility.

The NEM program was adopted by the CPUC in Decision (D.)16-01-044 on January 28, 2016 and is available to customers of PG&E, SCE and SDG&E. These are the three major investor-owned utilities in California who serve approximately 70% of consumers in California.

The current NEM program went into effect in 2016 and 2017, with changes made since. The program provides customer-generators full retail rate credits for energy exported to the grid but requires them to pay charges, non-bypassable surcharges, on each kilowatt-hour (kWh) of electricity they consume from the grid, even if there is no net consumption at the end of the billing period. Customer-generators are required to take service on a Time of Use (TOU) rate to participate in NEM. TOU rates more closely account for the difference in cost to provide electricity throughout the day, typically broken down into hour segments. As TOU rates more closely track actual costs of generation (higher in the afternoon and less at night) the implied differential, between wholesale avoided costs and retail, representing T&D, is reduced. This has the effect of reducing, albeit slightly, the subsidy to net metering customers.

Under NEM tariffs, participating customers receive a bill credit for excess generation. Each month, bill credits for the excess generation are applied to a customer's bill at the same retail rate (including generation, distribution, and transmission components) that the customer would have paid for energy consumption according to their otherwise applicable rate structure. This is partially offset by the non-bypassable charges noted above.

NEM customer-generators must pay the same non-bypassable charges for public services as other IOU customers, including Department of Water Resources' bond charges, the public purpose program charge, nuclear decommissioning charge, and competition transition charge.

At the end of a customer's 12-month billing (calendar) period, any balance of surplus electricity is trued-up at a separate fair market value, known as net surplus compensation (NSC). The NSC rate is based on a 12-month rolling average of the (wholesale) market rate for energy. That rate is currently approximately $0.02 to $0.03 per kWh. This rate structure was established in Commission Decision (D).11-06-016 pursuant to Assembly Bill (AB) 920 (Huffman, 2009).

Customer-generators may also receive compensation for the renewable energy credits (RECs) associated with their excess generation. To receive compensation, a customer-generator must register their generation facility with the Western Renewable Energy Generation Information System (WREGIS) and follow the eligibility guidelines contained in the latest version of the Overall Renewable Energy Program Guidebook from the California Energy Commission.

NEM customers that began prior to these dates were grandfathered into the former NEM tariff, pursuant to Decision (D.)14-03-041. These customer-generators are allowed to remain on the former tariff for 20 years from the date they interconnected, or they are permitted to switch to the current NEM tariff . The former NEM tariff is sometimes referred to as "NEM 1.0", and the current NEM tariff as "NEM 2.0" or "NEM Successor Tariff." California is moving slowly and deliberately away from overly generous NEM compensation but eliminating program capacity limits. Individual projects are limited in size to the customer’s load.

Key differences between the two tariffs are shown below:

Indiana

In May 2017 Indiana SB 309 lowered the retail rate for NEM customers and ultimately phased out retail net metering. Senate Bill 309 went through many revisions after introduction in the Legislature, with lawmakers first including then scrapping a controversial "sell-all, buy-all” provision. They also grandfathered systems installed by the end of 2017 under the retail rate for 30 years, but the rate will be lowered over a series of years for other customers after 2022 . Customers with generation installed after 2022 will be compensated at the utility's marginal cost of generation plus 25%. This strikes a balance between existing NEM customers who acted based on then- existing policies yet corrects the policy of overcompensating NEM customer-generators going forward. Indiana should reconsider the 25% premium paid above marginal cost, and step down the premium as more NEM customers come on line.

Oklahoma

In July 2019, Oklahoma revised its net metering law. An addition was made to Subchapter 9, (40:9-3(b)), which requires utilities to compensate net metering customers for any excess production, any energy supplied by the distributed generation facility above that consumed at that location. The new rules require that the excess energy be purchased by the utility at the utility’s avoided energy cost. Prior to this rule change, customers were not provided any compensation for excess production.

Further, these rules now require that the excess generation compensation be paid or credited in the next billing period. The project size limit was increased to 300 kW from 100 kW and removed the annual 25,000 kWh limit. It expanded the list of eligible technologies. Customers can now carry over credits to the next billing period. but limits recovery to 125% of the customer’s peak load. This limit was added to ensure that the production of the net metering customers was limited to only cover the expected consumption at that location.

Net metering customers will be paid for excess generation but if the installed distributed generation is sized to exceed the 125% of peak load, customers may be excluded from the netting option and instead be paid under the small power producer or the Qualifying facilities rules implementing PURPA.

Oklahoma has taken a conservative approach, allowing net metering but at the reasonable pricing, avoided cost, that eliminates the cross subsidy for transmission and distribution from one customer type to another. Net metering is open to a broader range of customers but paid at a more reasonable rate that protects other customers.

Wyoming

Wyoming’s statewide net metering policy is contained in Title 37, Chapter 16, Article 1 of Wyoming statutes. It applies to all utility types. The maximum system capacity eligible for the program is 25 kW, which excludes most commercial and industrial customers. Further net surplus generation is credited to the customer in kWh rather than dollars, during each billing cycle but paid a seasonal average avoided cost for net annual generation. Utilities cannot charge net metering customer any additional fees for their use of the grid (e.g. transmission and distribution) that are not paid by non-net metering customers. Ownership of Renewable Energy Credits (REC) is not addressed. Meter aggregation is not addressed in Wyoming statutes or regulations.

In November 2019 several bills were introduced to repeal or change the state’s net metering statute. The Legislature’s Corporations, Elections and Political Subdivisions Committee voted not to advance two bills to the full Legislature. The other bills were not taken up. According to the Office of Consumer Advocate, net metering systems still provide customers generating electricity with subsidies.

“This causes the usage based kWh rate [generally applicable] to then be approximately 1.5 times more than would otherwise be necessary, in order to recover the fixed costs that are not otherwise reflected in a demand charge or a fixed monthly customer rate.”

Wyoming is perhaps the most closely aligned with an ‘ideal’ net metering policy, but would benefit from a refinement such that fixed and volume based rates are more closely aligned with fixed and variable costs.

Summary, Conclusions, and Recommendations

Disproportionate favoritism to some also disproportionately penalizes the rest. Overly aggressive net metering policy that overcompensates NEM generation at the state level does just that.

Current NEM policies that pay full retail rate, such as in Arkansas, should be reformed as soon as possible so that rates are fair and reasonable for both net metering and non-generating customers alike. Five of the six states looked at in this report have done so to an extent and are on paths to do more. Arkansas has opened the door to doing so and should walk through. They are the only state of the six discussed in this update who continue to pay full retail for excess generation and allow this excess to be accumulated in perpetuity, a situation that will be hopefully rectified in 2021.

Having higher effective subsidies is not the only aspect of net metering that puts Arkansas ‘out front’- even out front of progressive states like California. Arkansas’ meter aggregation policy is significantly more lenient and accommodating towards net metering, even stretching the definition of net metering. Arkansas should reconsider their aggregation policies by putting reasonable limitations on the practice before they rend irreparable the regulatory compact.

As rooftop solar and other DG systems become more widely used, net metering policies and rate structures should be periodically updated so that everyone who uses the electric grid pays their fair share to sustain its smooth and reliable operation, including imposing non-bypassable surcharges for public purpose programs and shared infrastructure.

This approach ensures that all customers have safe and reliable electricity and that electric rates remain fair and affordable for all customers, while providing appropriate incentives to invest in necessary electrical power generation and grid infrastructure.

Regarding NEM, this report recommends that state legislators and utility regulators:

Continue to accelerate the reform of net metering to enhance market equity, efficiency, and cost-effectiveness. This entails moving away from retail rate NEM compensation and explicitly acknowledge cost of transmission and distribution. This approach may include imposing on net metering customers non-bypassable system benefit charges to cover transmission and distribution and environmental programs. It also entails the need to improve matching of net metering project size limits to customer loads.

Promote policies—and advocate for analytic efforts—based on the principles of cost effectiveness and cost efficiency rather than just benefit/cost or so-called ‘value’ studies. This includes lowering the maximum size limits to mirror historical customer load, thus reducing the ability and amount of net excess generation.

Ensure just and equitable ratemaking based on true cost of service. Ratemaking policies should be technology and consumer- type neutral and instead seek to maximize the benefits to all consumers with reliable, affordable service at just and reasonable rates.

Make greater use of time of use pricing for generation, transmission, and distribution.

Encourage FERC to reconsider asserting jurisdiction over net metering, especially as it pertains to meter aggregation, and treat such as wholesale transactions.

About the Author

Tom Tanton is the Director of Science and Technology Assessment for E&E Legal. He is also president of T2 & Associates, a firm providing services to the energy and technology industries. T2 & Associates are primarily active in renewable energy and interconnected infrastructures, analyzing and providing advice on their impacts on energy prices, environmental quality, and regional economic development.

Tanton has 40 years of direct and responsible experience in energy technology and legislative interface, having been central to many of the critical legislative changes that enable technology choice and economic development at the state and federal level. Mr. Tanton is a strong proponent of free market environmentalism and consumer choice, and frequently publishes and speaks against alarmist and reactionary policies and government failures.

Until 2000, Tanton was the Principal Policy Advisor with the California Energy Commission (CEC) in Sacramento, California. He began his career there in 1976, developing and implementing policies and legislation on energy issues of importance to California, the U.S. and International markets. These included electric restructuring, gasoline and natural gas supply and pricing energy facility siting and permitting, environmental issues, power plant sitting, technology development, and transportation. Tanton completed the first assessment of environmental externalities used in regulatory settings. He has held primary responsibility for comparative economic analysis, environmental assessment of new technologies, and the evaluation of alternatives under state and federal environmental law.

As the General Manager at EPRI, from 2000 to 2003, Tanton was responsible for the overall management and direction of collaborative research and development programs in electric generation technologies, integrating technology, market infrastructure, and public policy. From 2003 through 2007, Tanton was Senior Fellow and Vice President of the Houston based Institute for Energy Research. He was also a Senior Fellow in Energy Studies with the Pacific Research Institute until 2010.